|

senior cat insurance choices that protect comfort and budgetYour cat slows on the stairs, water bowl empties faster, and lab notes start to show "borderline." The medical needs grow just as savings feel thin. Insurance can buffer that gap - if you choose well. And yes, some policies seem to promise the moon; read past the glossy charts. Clarify your cat's risks before shoppingKnow what you're actually trying to shield against. That focus drives better selection and better outcomes. Health profile checklist- Mobility changes: stiffness, reluctance to jump, short play sessions.

- Kidney flags: increased thirst or urination, weight loss, dull coat.

- Thyroid or heart signs: vocalization, restlessness, rapid breathing.

- Chronic issues: dental disease, hypertension, diabetes.

- Recent labs and diagnoses: anything already noted becomes crucial for exclusions.

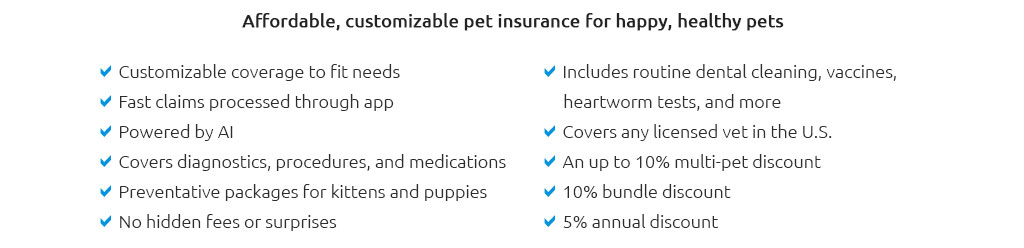

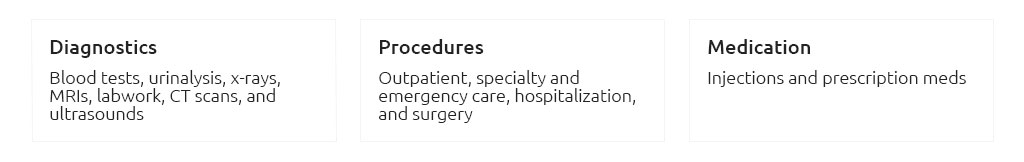

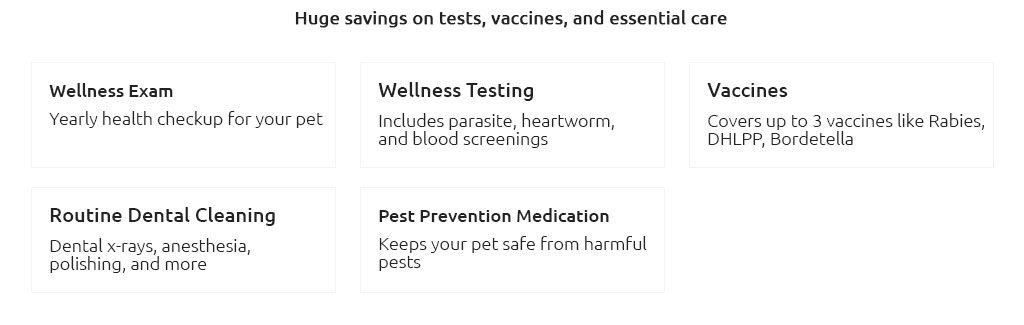

Policy features that matter most- Eligibility and waiting periods: Confirm maximum enrollment age and any extended waits for orthopedic, cardiac, or renal conditions. Outcome: fewer early-claim denials.

- Covers accidents and illnesses (not just accidents): Senior cats need chronic-illness coverage. Outcome: real protection, not just for rare mishaps.

- Deductible design: Annual vs per-incident. Outcome: predictable costs if you expect multiple visits.

- Reimbursement rate: 70 - 90 percent typical. Outcome: higher rates reduce shock bills but raise premiums.

- Annual limit: Pick a cap that fits worst-case scenarios (e.g., heart workups, hospitalization). Outcome: fewer out-of-pocket surprises mid-year.

- Exclusions and lookbacks: Pre-existing definitions, bilateral conditions, dental illness rules. Outcome: clarity about what won't be paid - before the bill arrives.

- Exam fee and prescription coverage: Small line items that add up for seniors. Outcome: steady savings on frequent visits.

- Claims process: App-based filing, direct pay options, typical turnaround. Outcome: faster reimbursements when cash flow is tight.

Real-world moment: my neighbor's 14-year-old cat had sudden labored breathing on a rainy Tuesday; the emergency visit, oxygen, and imaging totaled 1,240. Her plan reimbursed 80 percent within six days - useful, though it excluded an older allergy noted in the chart. Estimate cost vs likely benefitPremiums rise with age and region. You can still stack the odds in your favor by matching deductible and coverage to expected care. Quick decision math- List the next 12 months of predictable care (rechecks, labs, meds).

- Price one or two plausible emergencies (urinary blockage, CHF flare, pancreatitis).

- Choose a pain line - what's the max you'd comfortably pay in a single event?

- Select deductible and cap so the plan meaningfully reduces those events below your pain line.

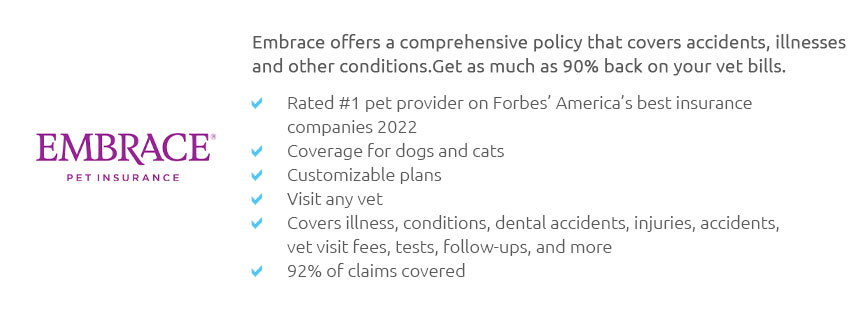

How to compare providers without overwhelm- Gather two to three quotes using the same cat age, location, deductible, and reimbursement for apples-to-apples.

- Read the sample policy, not just the brochure. Search for "pre-existing," "waiting," "bilateral," and "dental."

- Check customer timelines for claims resolution, not just star ratings.

- Ask your vet if they see frequent denials from a given insurer. Skeptical, but practical.

Apply cleanly to avoid surprises- Request complete medical records from your vet before enrolling.

- Disclose everything; omissions can void coverage.

- Schedule a baseline senior exam and labs if the policy requires it.

- Save a PDF of the exact policy version you accept.

After enrollment: set up for good outcomesCreate a simple folder for invoices, itemized treatment notes, and lab results. Consistent documentation speeds reimbursements. Claim timeline playbook- Pay and ask for an itemized invoice plus doctor notes at checkout.

- File the claim the same day with clear photos or PDFs.

- Track the claim number; respond quickly to any requests for records.

- Verify the explanation of benefits; appeal politely with citations if something seems off.

The goal is simple: a plan that quietly absorbs the big shocks while you handle the small stuff. Choose for the cat you have, not the brochure cat. Do that, and the outcome is calmer decisions on hard days - and a senior who gets care without hesitation.

|

|